This article is a part of your HHCN+ Membership

It’s the interest rate, stupid.

Home health, home care and hospice industry voices – including myself – have regularly pointed toward internal factors affecting M&A over the last two and a half years. In the end, the overarching, main headwind was always the extremely high interest rates that were put forth by the Federal Reserve to combat inflation.

Those internal factors had an effect on the specific M&A that did occur, and they will have a major effect on the M&A activity that occurs moving forward.

But searching for internal reasons to find out why M&A had cooled since early 2022 was largely a fool’s errand.

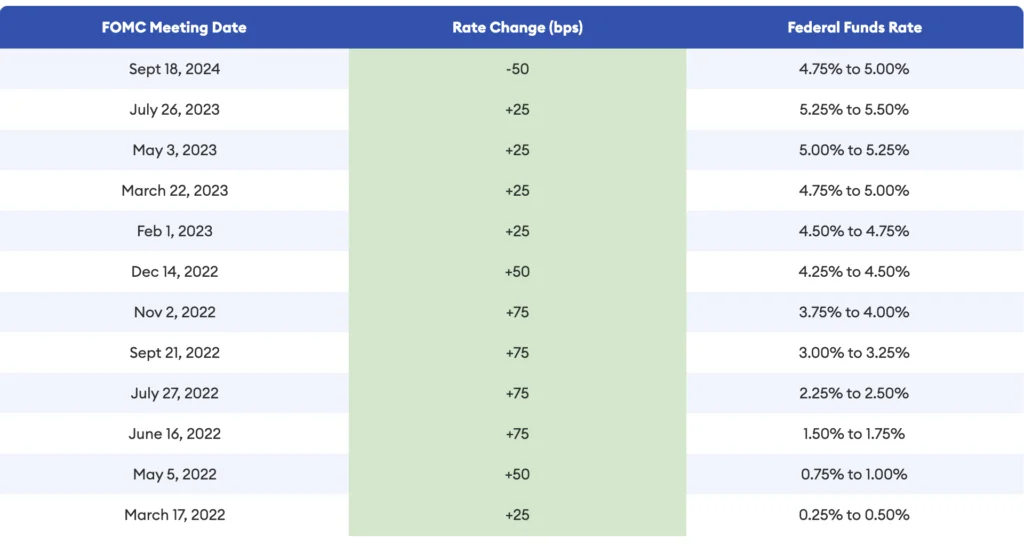

In March of 2022, the Fed started moving historically low interest rates up a notch. Specifically, on March 17, 2022, the federal interest rate moved from near-zero to 0.50%. Then, those hikes continued on a consistent basis, up until July 26, 2023, when the federal interest rate hit 5.50%.

On Wednesday, the Fed announced a half-percentage point cut to the interest rate, in what is expected to be the first of a few cuts as it now turns its eyes toward other problems outside of inflation.

Meanwhile, the trend line for home-based care M&A ran diametrically opposed to the interest rates. As interest rates rose, home-based care M&A fell, besides a few small spikes in a quarter or two.

“I believe the interest rate environment has really been more significant than perhaps people have acknowledged,” Les Levinson, partner and co-chair of the Transactional Health Law Group at Robinson + Cole, told me this week on a webinar. “When you were doing deals in 2021 and 2022 – at what was functionally equivalent to a zero interest rate environment – you needed a lot less equity to do a deal. And the risk in that transaction was being basically covered by debt coverage. That evaporated as interest rates shot up.”

In this week’s exclusive, HHCN+ Update, I’ll dive into the interest rate cut and what it will mean for the home-based care M&A market in the near-term future.

Rate cut kickstart

All signs point to Wednesday’s rate cut being the first of a few, as the Fed begins to focus more on unemployment and less on inflation.

Based on the last couple of years, that would suggest that we’ll see far more transactions in home-based care in the near-term future.

After that first hike in March 2022, things changed in the formerly robust M&A landscape.

In Q3 and Q4 of 2020 alone, there were 95 total transactions in home health, home care and hospice, according to the M&A firm Mertz Taggart. Over the same time period in 2021, there were 106 transactions.

Then, in 2022, after the first rate cut, Q3 and Q4 saw 50 total transactions, an over 50% decrease compared to the year prior.

Outside of a few quarters with modest spikes, M&A has stayed historically down, up until present day.

Private equity-sponsored deal counts, too, were historically low.

Now that the interest rate trend line is on the other side of the mountain, expect home-based care activity – and PE-backed activity – to pick up.

“We’re at the tail end of an almost five-year cycle that started with COVID and the Fed stimulating the economy,” Mertz Taggart Managing Partner Cory Mertz told me on the webinar. “Interest rates went to about zero. Sellers were burned out. They wanted to get out early before the election and a new administration increased the capital gains tax rate. It was really a perfect storm of activity, and it was, quite frankly, a bubble. The Fed raised fund rates at a pretty healthy clip starting in 2022, and that really slowed everything down for a couple of years. But now, we’re starting to see signs of life.”

The Fed was expected to lower rates Wednesday, and most were waiting to see whether it was by a quarter or half of a percentage. Its decision to go the latter route will open things up even further than previously expected.

Over the next year or two, it’s likely the rate will continue to tick down toward around 3%.

During the quiet period, demand for quality home-based care assets has not been down, according to Mertz. Instead, the market conditions have kept transaction levels down. Those market conditions also include the fact that, with near-zero interest rates and a rush toward home-based care during the pandemic, multiples climbed significantly.

Since then, buyers have waited for the multiple expectations to normalize.

“These same buyers have still been hungry for quality deals,” Mertz said. “They don’t want to, and they’re not willing to, pay a premium for deals that don’t warrant a premium [price]. Now, premiums today compared to premiums in 2021 or 2022 are down a little bit, but not a whole lot. For a quality agency, at least. That’s my experience.”

As multiple expectations are balanced out, though, it’s likely that demand finally rises up and brings deals to fruition.

But active, quality home health agencies – in particular – have become more scarce over the last few years.

“A quality home health asset, I think, is the premium in post-acute care,” Choice Health at Home CEO David Jackson told me on the webinar. “Hospices have a really nice base. Home care [agencies] have really steady valuations, much more steady than the others. They don’t go up and down as much as a premium home health care asset that is doing well from a compliance, quality and financial perspective. Those are becoming more and more rare every day, and that’s because it’s a very difficult industry.”

Based in Tyler, Texas, Choice Health at Home provides a wide range of services in the home, including home health care, home care and hospice. Backed by Coltala Holdings and Trive Capital, the company has executed over 20 transactions in the last four years. In addition to Texas, it has a presence in Nevada, Utah, Colorado, Arizona, Oklahoma and Kansas.

In home health care, buyers generally prefer executing deals in the back half of the year anyway, and particularly in Q4. That’s because, after the Centers for Medicare & Medicaid Services (CMS) releases the final home health rule in October or November, there’s generally more certainty around payment.

A lot has changed

While deals have been put on ice, a lot has changed under the surface.

As buyers and sellers get back to the table, they’ll be discussing home-based care sectors that don’t look like they did three to four years ago.

In home health care, CMS has proposed three cuts to payment, and finalized two. More than 50% of Medicare beneficiaries are now underneath a Medicare Advantage (MA) plan, too. MA plans tend to be far less for home health services than traditional Medicare.

Home health providers – even the quality ones – are struggling to adjust to a world with a less certain payer landscape. They are dealing with CMS cuts to traditional Medicare, while also vying for higher rates from MA plans. Some have even cut ties with MA plans to prove a point, and also to allocate their resources to better payers.

In home care, the finalized Medicaid Access Rule included the 80-20 provision, which would mandate that 80% of reimbursement for home- and community-based services (HCBS) go to workers. That provision won’t be implemented for another nearly six years, but it is still likely to affect M&A.

For instance, on one end, many providers believe that scale is necessary to sustain business performance under such a provision. Addus Homecare Corp. (Nasdaq: ADUS) has stated this regularly and has also been a very active acquirer of late.

Outside parties, however, may see the provision as a reason to avoid HCBS – for now.

Addus has also benefited from the M&A downturn itself. While interest rates have been high, Addus has significantly expanded its home health and home care footprints.

“Realistically, over the last 12 to 18 months, we’ve not seen a lot of competition out there,” Addus CEO Dirk Allison recently said. “There’s been the occasional smaller strategic player that’s bought a few deals on a localized basis. From a PE standpoint, it’s really been very slow as far as competition for the last bit. Now, obviously, if rates come down in September, as everybody’s expecting, there’ll be a point where PE will come back in and that’s fine. It’s been a market in which up until the last year or so, we’ve always operated with competition from those folks.”

VitalCaring President Luke James also told me earlier this year that there were advantages to growing during an M&A and payment downturn. His company also recently agreed to acquire divested assets of Amedisys (Nasdaq: AMED), but that deal is contingent on the Optum-Amedisys deal closing first.

Either way, if the Fed continues on the path it set out on this week, times are changing.

When M&A ticks back up, buyers will have different factors to consider. But the buyers – the formerly dormant strategics and private equity players – will be back.

The home health and home care sectors have been labeled as ripe for consolidation over the last decade. But consolidation has not come as quickly as many believed it would.

Now that the dust is settling, however, M&A has the chance – again – to reshape the face of home-based care.

Companies featured in this article:

Addus HomeCare Corp., Choice Health at Home, Mertz Taggart, Robinson+Cole, The Federal Reserve, VitalCaring